I believe you should only trade in what I call deliberately trading markets. As a trader, you’re looking for a market that moves up and down in a smooth, even fashion. Why?

Isaac Newton’s first Law of Motion stated, “A body in motion tends to stay in motion unless acted upon by an outside force.”

Now, Newton probably wasn’t taking about trading, but his First Law of Motion is why we look for smooth markets. And if a market has been moving in a particular direction, it tends to keep moving in that direction unless acted upon by an outside force, which will appear as a change in price direction.

So take a look at this chart:

It doesn’t matter if you don’t know how to read charts like this. Just look at the smooth movement of this chart. This is a deliberately trading market where one day’s price action looks very much like the prior day in terms of the range of the price from the high to the low.

There are no unusually wide-range days here where the price jumps up very, very high and then collapses down very, very low, or closes somewhere in the middle. You don’t see any of that on this chart.

You don’t see any unusual gaps in price where the market from one day to the next might jump up or might jump down several dollars, creating a gap. You don’t see that on this chart. You see a chart where the market is in motion and it's staying in motion, undulating a bit but going steadily up.

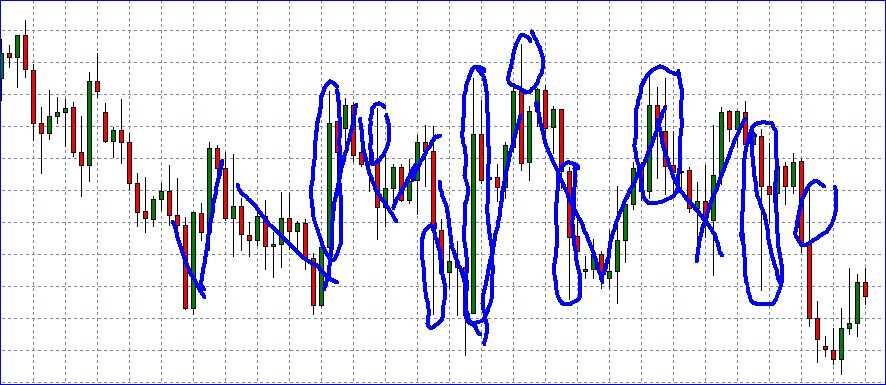

Okay, now look at this chart:

This is an example of a market that is definitely not deliberately trading. You’ve got several very wide-range days on the price action. You have gaps in prices. You have a helter-skelter kind of price action.

From one day to the next, you don’t know if this market is going to go up or go down. You don’t know what’s going to happen. It looks like an electro-cardiogram where it just bounces back and forth, all around.

This kind of price action spells risk. It is definitely not a market that is in motion and staying in motion. It's a market that’s encountering opposite forces all the time, day in and day out. You want to stay out of this kind of market.

There’s no need to trade this kind of market when you can trade a deliberately trading market. So what most people do when they try to make money in the markets is they just pick or follow someone else’s recommendation without regard to understanding deliberately trading markets.

And even if they have a proven trading plan, the odds are stacked against them if they attempt to trade non-deliberately trading markets. But if they only trade in markets that are deliberately trading, the odds are overwhelmingly in their favor.

And of course when it comes to trading, there’s no such thing as a crystal ball, so the way to build massive potential wealth is to do everything that you can to maximize your odds of success, and that’s why a deliberately trading market is such a big deal.

So you can pick any stock, ETF, forex market or whatever and apply this secret to it, and you’ll know in an instant whether to stay away or whether to consider trading it. The next time you hear about a stock on television, in the news or from a friend, pull up the chart and ask yourself: “Is this a deliberately trading market?”

Just doing that one simple thing will give you a big advantage over all the other people who don’t even think to consider that, and that really is a big, big deal.

You May Like