A certain signal, created by a Nobel Prize winning professor from Yale University, is warning investors of coming danger.

As a result, market makers are getting nervous.

Many are predicting a massive market downturn is right around the corner.

Mark Zandi, chief economist at Moody’s Analytics said, “The stock market is due for a significant correction.”

Tom Forester, chief investment officer at Forester Capital Management elaborated further. He pointed out that the last two crashes were sparked by one industry’s failure. In 2000, the tech bubble burst. In 2008, the sub-prime mortgage fiasco brought the market to its knees.

Today, things look much worse. Forester fears almost every sector is overvalued. That is certainly true when it comes to the S&P. Nine out of ten of its sectors are more expensive today than their historical 10-year average.

Forester warns that the coming bear market is, “going to be agonizing.” He says, “There won’t be anywhere to hide on the way down.”

He’s not alone in his analysis. Famous Swiss investor, Marc Faber shares similar sentiments. He explains that, on the New York Stock Exchange alone, more stocks are being purchased on margin than at any time since the 1950s.

Investors keep borrowing money to buy because stock prices are out of control expensive. This gross overvaluation is a strong indicator of an imminent correction in the markets.

Faber says, “I think a realistic scenario is that asset holders will lose 50% of their assets. Some people will lose everything.”

Legendary investor, Jim Rogers (he founded Quantum Fund with George Soros) agrees and, adds that the coming crash is, “going to be the biggest of my lifetime.”

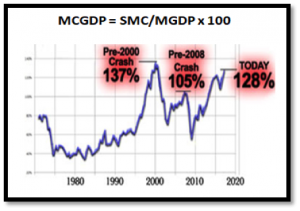

The market “omen” these titans of investing are looking at is called the Shiller P/E Ratio. This ratio was created by Nobel Prize Laureate and Yale University Economics professor, Robert J. Shiller. It measures the market’s valuation.

The historical mean of this ratio is only 16.8. Today, however, the Schiller P/E is 88.7% higher sitting at 31.7. The only other times the ratio was higher than today was in 1929 and in 2000. It is now 132% higher than its peak of 24.02 before the 2008 Financial Crisis.

What this means is simple. The markets are on the edge of collapse once again. However, smart Main Street investors are not panicking. Instead, they are getting their hands on a brand new Research Report that spells out exactly how to take advantage of the coming crash.

The report details an investment strategy for

capitalizing on falling markets. This strategy allows regular investors to: Keep their risk of investing down by as much as 92.5%. Gain up to 12 times bigger profits compared to stocks. Earn positive returns even as the market crumbles.

The secret? Using stock options. Many beginning investors needlessly worry that options are too confusing or too scary. But here at Profits Run – a small financial education company in Michigan – we’ve made it simple to get started.

Just download your complimentary copy of Simple Options Trading For Beginning. Written in plain English, this free book reveals everything you need to know to start trading options. To get a copy, simply enter your email address below.

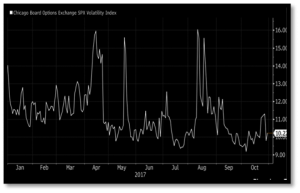

The stock market keeps hitting record highs. Economic growth is steadily rising. Interest rates remain low. And inflation is of no concern.

The stock market keeps hitting record highs. Economic growth is steadily rising. Interest rates remain low. And inflation is of no concern. In other words, euphoric investors are “hooked” on the record-setting market. But they refuse to pay attention to obvious signs a big market correction is right around the corner.

In other words, euphoric investors are “hooked” on the record-setting market. But they refuse to pay attention to obvious signs a big market correction is right around the corner. Perhaps scariest of all is the sentiment shared by Peter Tchir, managing director at Academy Securities Inc. Mr. Tchir said point blank, “It scares me that I don’t havea ‘scary’ chart.”

Perhaps scariest of all is the sentiment shared by Peter Tchir, managing director at Academy Securities Inc. Mr. Tchir said point blank, “It scares me that I don’t havea ‘scary’ chart.”

A recent comment from legendary trader, Paul Tudor Jones, has investors worried.

A recent comment from legendary trader, Paul Tudor Jones, has investors worried. Picking stock market winners is simple.

Picking stock market winners is simple. The mainstream media is quick to point out the obvious.

The mainstream media is quick to point out the obvious.